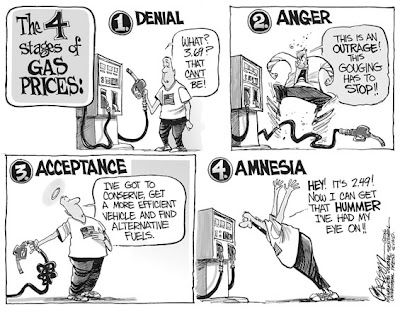

Despite history of bountiful production, we are no longer a country know for making very many things. One thing that we do have a talent for producing, perhaps better than anyone else, is “hype”. With its contagious force, 100% pure American-made hype can surge from coast to coast and beyond. Hype allows for a select few topics to rise above the countless other bits of information that are all struggling to reach us via a thirty-second sound byte. A key goal of successful hype is eliciting the strongest response from the greatest number of recipients. Historically, one of the topics that has been consistently successful in the world of hype is oil, particularly its relationship with gasoline prices. Amidst the rising tide of the upcoming presidential elections (a prime breeding ground for hype), gas prices have re-emerged to claim valuable reporting time as the average price for regular gasoline approaches $4 a gallon even before the surge of summer driving.

Despite history of bountiful production, we are no longer a country know for making very many things. One thing that we do have a talent for producing, perhaps better than anyone else, is “hype”. With its contagious force, 100% pure American-made hype can surge from coast to coast and beyond. Hype allows for a select few topics to rise above the countless other bits of information that are all struggling to reach us via a thirty-second sound byte. A key goal of successful hype is eliciting the strongest response from the greatest number of recipients. Historically, one of the topics that has been consistently successful in the world of hype is oil, particularly its relationship with gasoline prices. Amidst the rising tide of the upcoming presidential elections (a prime breeding ground for hype), gas prices have re-emerged to claim valuable reporting time as the average price for regular gasoline approaches $4 a gallon even before the surge of summer driving.

One of the problems with hype is that it makes the difficult task of conveying the entire story in the news even more difficult as it battles with increasing emotional weight from viewers. Hype’s viral nature allows it to feed on itself with the potential to grow exponentially, regardless of the accuracy of the underlying information, before eventually reaching a swift death, most likely at the appetite of new hype.

Like milk, our constant use of gasoline makes it (as of now) vital to the functioning of our economy. In 2008 Americans consumed around 380 million gallons a day so fluctuations in its price are felt quickly by the populace. Undeniably, the prospect of higher gas prices brings a cost that will have a material affect on the stability of our economy and its potential for growth.

When in comes to the realm of hype, the familiarity of gasoline’s residency is matched by a particular suggested solution: more drilling for oil. Fervently presented by its proponents, the case for more domestic oil drilling revolves around a seemingly simple equation of supply and demand; that if we have more drilling rigs then our supply of oil will rise and the price will fall. In its simplest form this is accurate and given that hype struggles with increasing complexity, it survives well as a fast-tracked bullet point.

The problem is that it, like most other things in our society, is more complicated than that and the rest of the story is very important. Increasing more drilling rights or expediting the review process for new drilling, as President Obama has recently done, will not have immediate, material affects on the price of gas. The process from permitting to an increased supply of oil from a new well can take ten years, meaning that proposing “more drilling” for the high gas prices would be the same as proposing to plant more vineyards for a high price of wine. Could it eventually help offset some of national oil demand? Perhaps, but according to the EIA the capacity for ANWR and offshore sites to significantly affect gas prices is limited.

If more drilling was presented as a component to a long term energy plan, then I would have less of a problem with it. Instead, it is presented in an expedited way of half-truths in an attempt to create a point of debate for the next election with neither side offering real solutions to the underlying issue. The residual casualties can become things like focus on important topics like renewable energy. A recent report showed that American support for alternative energy construction declined in deference to more support for fossil fuel extraction–a choice no doubt affected by the assumption that more drilling will provide gas price relief.

Hype also has its share of unintended casualties. A recent poll conducted by Pew Research Center revealed that a slimmer majority of Americans prioritized renewable energy development over expanding exploration and production of fossil fuels. While 63% reportedly favored renewable technologies a year ago, the number dropped to 52% in 2012, likely due to the desire for cheaper gas and the impression that more oil production in the United States will provide quick relief to local gas prices. Unfortunately, this could mean that we are taking time, energy and focus away from components of a long term solution in order to pander to a false pretense of the possibility of a quick fix.

Possible Solutions?

The oil is a finite resource which means that if our rate of consumption remains constant in the short term, the price will continue to rise. If lowering the price of gasoline is a goal of our society then we are not without options to do so:

Lift the Value of the Dollar:

Like most commodities, oil is priced in U.S. dollars. Our government has been positioning a weak dollar for some time now in order to make American products more attractive for export to other countries. It also, however, makes the price of imported commodities more expensive for us.

Reduce Consumption:

Continuing to reduce how much oil we use will help depress demand and its price. This could be through more improvements to the efficiency of our vehicle fleet or a continued migration to mass transit, allowing us to drive less. It could also be affect by how we heat our buildings and the use of virgin plastic.

Release Strategic Oil Reserves:

Though decidedly temporary, it would be possible to flood the market with supply of domestic oil through the liquidation of our nation’s strategic oil reserves.

What Will Actually Happen?

Oil prices will likely rise moving into the summer, only exacerbated by any rise in tensions with the Middle East. Higher gas prices will have a material effect on middle income Americans, not only for commuting but for our food supply that is hit doubly hard by costly petroleum (once by the oil needed for chemicals and again by the gas needed for transport; this is just one more reason why our agricultural system needs to change). If gas prices remain high then some form of subsidy could be granted to farmers in order to keep food prices low.

Unfortunately, what most likely will not happen is a comprehensive approach to dampen our country’s dependence on oil despite the fact that it is wiser and easier than the impossible task of keeping gasoline perpetually cheap.

Image Credit: immobilienblasen.blogspot.com , dcstreetsblog.org